Can machines really predict the unpredictable stock market? For decades, investors have chased the holy grail of accurate forecasting. Charts, expert opinions, and even gut feelings have guided decisions — sometimes with success, often with painful misses. But in 2025, a new player is reshaping the game: artificial intelligence (AI).

Why Stock Market Predictions Matter

The stock market is exciting, but it’s also a roller coaster. Prices swing because of earnings reports, political changes, or even a viral post on social media. Traditionally, people leaned on:

- Analysts and expert opinions

- Technical charts and indicators

- Economic or political signals

The problem? These methods can’t always keep up with today’s flood of information. That’s exactly where AI is stepping in.

How AI Is Predicting the Market in 2025 ?

What makes AI so powerful is its ability to crunch massive amounts of data in seconds. Here’s how it’s doing it:

- Machine Learning (ML): Spots hidden patterns humans might miss.

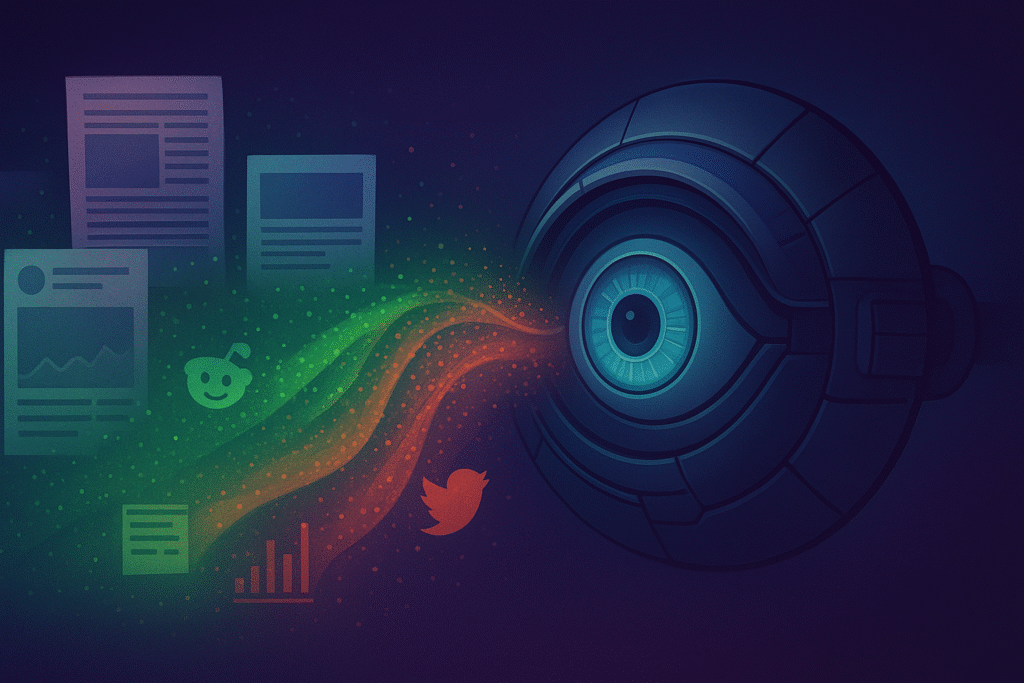

- Natural Language Processing (NLP): Reads news, financial reports, and even Reddit threads to understand sentiment.

- Algorithmic Trading: Executes trades in milliseconds, catching opportunities before they disappear.

- Predictive Analytics: Blends past data with real-time insights for sharper forecasts.

Instead of replacing investors, AI acts more like a high-powered assistant — giving you an edge in decision-making.

Real-World Examples You’ll See This Year

AI isn’t just for Wall Street elites anymore. In 2025, it’s everywhere:

- Hedge funds are running AI-powered strategies worth billions.

- Retail apps are offering everyday investors AI insights once reserved for professionals.

- Platforms like X (Twitter), Reddit, and financial news are tracked by AI to detect shifts in investor mood.

- Small investors now have access to tools that were once locked away in hedge fund offices.

This is one of the most exciting shifts: AI is leveling the playing field.

The Limitations & Risks

Of course, no technology is perfect. AI can’t predict sudden world events, like political crises or natural disasters. It’s also only as good as the data it learns from — and bad data can mean bad predictions. Finally, there’s a risk in relying too much on machines. Human judgment still matters, especially in unpredictable markets.

What’s Next for AI in Stock Predictions?

Looking forward, the future seems less about “AI vs. humans” and more about AI + humans. Investors who mix intuition with AI-driven insights will likely do better than those who lean only one way.

At the same time, these tools are becoming more accessible, opening opportunities for everyday traders. And with all this growth, regulation will probably follow to keep AI-driven trading fair and stable.

Final Thoughts

AI is changing how we predict the stock market — making forecasts faster, sharper, and more widely available. But remember: it’s not magic. The winners of 2025 won’t be just humans or just AI. They’ll be the ones who know how to combine both.

FAQs

1. Can AI really predict the stock market?

2. How is AI different from traditional prediction methods?

3. What types of AI are used in stock market predictions?

4. Is AI only for big hedge funds?

5. What are the risks of relying on AI in stock trading?